Start a Bookkeeping Business

Bookkeeping Mission Statement

Bookkeeping Mission Statement

The National Bookkeeping mission statement is to enable junior or senior level bookkeepers with training and/or experience start a business that they can operate from home providing bookkeeping, training and support services to both local companies as well as remotely to small businesses across Australia.

In some circumstances National Bookkeeping Licencees can find work doing bookkeeping for local accounting firms or larger more established bookkeeping businesses.

Many small businesses are searching for a local bookkeeper who works to a high professional standard in their knowledge and diligence while also providing professional customer service.

What is Bookkeeping?

Bookkeeping starts as the coding of individual financial transactions that relate to a business. They can be categorised into some broad categories like:

- Income

- Expense

- Loan Repayment

- Capital injection

By associating each financial transaction with a category (usually called coding by accountants), small business owners get to understand the financial health of their business by the resulting reports such as Profit & Loss, Balance Sheet and Accounts Receivable Reports. These tasks make up the majority of daily transactions that occur within a business.

Commonly these days, business owners can do many of these tasks from their computer, tablet or smartphone and a good bookkeeper will ideally have the patience to teach their clients how to use the software as well as simply do the data entry work.

Bookkeeping is also about reconciling these transactions in their accounting software to the “real” information in their bank accounts to ensure the information is correct. Read more about bookkeeping..

Bookkeeping Tasks

Bookkeeping tasks can range from setting up of a companies chart of accounts, opening balances, creditors, debtors, bank and loan accounts, transaction accounts etc. This work however is normally performed in conjunction with an accountant who understands the needs and structure of the business.

Bookkeeping tasks can range from setting up of a companies chart of accounts, opening balances, creditors, debtors, bank and loan accounts, transaction accounts etc. This work however is normally performed in conjunction with an accountant who understands the needs and structure of the business.

Bookkeeping tasks were often performed in small businesses by the owners wife (for small trades) or a trusted worker because there wasn’t an expectation of professional accounting or taxation knowledge, but it’s now considered a profession particularly because it ties in with heavily regulated areas of our financial lives like superannuation.

Bookkeeping is considered a profession since financial performance information is now lodged with the ATO more regularly in the form of BAS’s for the purposes of GST reporting. Because this information is lodged directly with the ATO the person who performs this work must know what they are doing and sign off on the accuracy of the information. Tasks which relate to GST and Payroll must be performed by a Registered BAS Agent and there are low cost opportunities to join Natbooks as a Registered BAS Agent.

Read more about the common categories of bookkeeping tasks and the requirements to be a registered BAS agent.

Earnings Guarantee*

Earnings Guarantee*

If you have experience and education you are in a great position to transition from employee to starting your own business as an independent contractor.

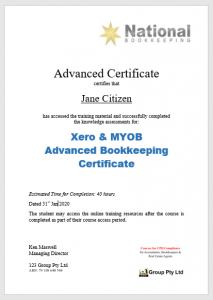

If you can adapt to change, understand how to sell your contracting services you can do well even if you have experience and only short course and received an advanced bookkeeping certificate.

Our goal is to find the best quality applicants who want to start their own bookkeeping business so check out our membership plans to see where you fit and then Pre Qualify to help us determine whether we can offer you an earning guarantee with your membership.

Evolution of a Bookkeeper

Many of the daily transactional tasks that most small businesses need to enter into their bookkeeping software (data entry) is a time consuming task that most small business owners and managers don’t want to do for themselves.

Many of the daily transactional tasks that most small businesses need to enter into their bookkeeping software (data entry) is a time consuming task that most small business owners and managers don’t want to do for themselves.

This work and work like it can only be outsourced to an external bookkeeper if the cost of doing so is reasonable.

Many people we speak with who are just starting out as a bookkeeper are happy to do this work at a lower rate while they expand their knowledge and experience.

Many of our licencees are professionally trained accountants who now prefer to work closer to home, with a shorter commute than working in a larger busy city centre, and also shorter (school friendly) hours.

Tasks Performed and Rates of Pay

Many of the tasks performed by a bookkeeper are boring and repetitive and business owners don’t like doing it and are happy to pay someone else to do it for them. Some of these tasks include:

Many of the tasks performed by a bookkeeper are boring and repetitive and business owners don’t like doing it and are happy to pay someone else to do it for them. Some of these tasks include:

- Following up with clients for payment,

- processing payment instalments, and

- managing weekly commitments like Payroll

If you can perform these tasks efficiently during your work hours so you can finish up and spent time with your family then you’re in a great position to do this kind of work. These tasks can even be performed from home using software like Xero and QuickBooks Online and can enable you to work from home.

Learn more about the rates that bookkeepers charge for their services. Keeping in mind that the more complicated the tasks the higher the rate and if your bookkeeper is going to lodge your BAS’s they’ll also have their Registration and reputation on the line.

Professional Standards for Bookkeepers

If you are accepted to join National Bookkeepers you’ll need to agree to the National Bookkeeping Code of Professional Conduct and offer a Professional Services Agreement for the work you perform for your small businesses clients.

If you are accepted to join National Bookkeepers you’ll need to agree to the National Bookkeeping Code of Professional Conduct and offer a Professional Services Agreement for the work you perform for your small businesses clients.

This way you understand the commitment required to run a first class bookkeeping business while saving on the costs of being part of a franchise.

These professional standards are also important for our licencees because their is an expectation that their own invoices will be paid for promptly and that they are highly regarded as a contractor to small businesses.

Training and Quality

When you join National Bookkeeping you’ll go through our training and induction programs so your accounting software knowledge and industry knowledge is at a confident and competent level.

Your membership provides you with ongoing education on many different aspects of bookkeeping, accounting and taxation, business and marketing support and introductions to practising bookkeepers & BAS Agents.

Bookkeeping qualifications are available from hundreds of different RTO’s (Registered Training Organisations) in Australia and these skills are important for all bookkeepers so they remain current in their skills and legislation, but also so they can increase the services they offer and the rates they receive as a result.

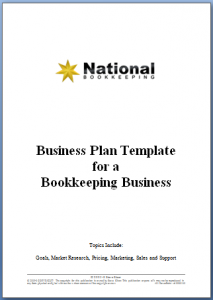

New National Bookkeeping Licencees are offered the Small Business StartUp and Admin Course, which comes with a bookkeeping business plan created by our BAS Agent Jacci, to use as a template in their studies. This course not only helps licencees operate their own business professionally but enables them share this knowledge with their small business clients.

We are strong believers in education for our members as well as for our members to deliver to their own clients so as a member you’ll have access to digital marketing and course material support as well as offers for your clients.

Training Courses Included!

National Bookkeeping includes access to these courses as part of your licence:

Small Business Startup and Admin Courses

Small Business Startup and Admin Courses- MYOB Accounting Software Courses (Beginners to Advanced)

- Xero Cloud Accounting Software Courses (Beginners to Advanced)

- QuickBooks Online Training Courses (Beginners to Advanced)

- Microsoft Excel Training Courses (Beginners to Advanced)

- Microsoft Word Training Courses (Beginners to Advanced)

- Microsoft Office Outlook Trainin Courses

- Microsoft PowerPoint Training Courses

You have a knowledge base and education resources to help you with software or internet services required to help you manage your own business as well as aspects of your clients businesses.

Dozens of Template Files

Included in these courses are dozens of sample and template files that are used throughout the courses and also designed for your small business.

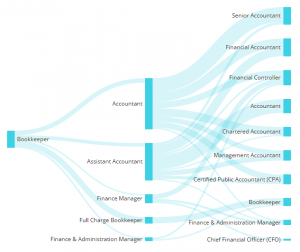

A Bookkeeper Pathway to a Financial Controller

Every business needs a bookkeeper and as businesses grow so do their needs for someone to control the financial performance. From conversations with our students we’ve seen how bookkeepers can evolve to perform more and more critical financial management aspects of a business.

Every business needs a bookkeeper and as businesses grow so do their needs for someone to control the financial performance. From conversations with our students we’ve seen how bookkeepers can evolve to perform more and more critical financial management aspects of a business.

With continuing training and education any bookkeeper can find themselves in senior management positions. Learn more about the potential career paths for bookkeepers.

Contract Financial Controllers

Cloud software, broadband internet and the rise of mobile devices has enabled small to medium businesses to find the human resources they need no matter where they are.

Your Bookkeeping Business Plan

If your goal as a bookkeeper is to evolve and become more valuable to your clients it needs to be part of your plan and you’ll want to constantly upskill and learn about the accounting industry but also about the technology and needs of small business.

If your goal as a bookkeeper is to evolve and become more valuable to your clients it needs to be part of your plan and you’ll want to constantly upskill and learn about the accounting industry but also about the technology and needs of small business.

View the contents of the existing business plan (created by our Registered BAS Agent) and modify it to suit your own circumstances and goals, then follow it to achieve success in your own business.

Sales and Marketing for Bookkeepers

Many bookkeepers dread the idea of selling because they are almost seen as opposing job roles, but marketing and selling your services is just as important in a bookkeeping business as any other business.

Many bookkeepers dread the idea of selling because they are almost seen as opposing job roles, but marketing and selling your services is just as important in a bookkeeping business as any other business.

The Internet has changed how businesses use accounting software and it has also changed the way businesses find bookkeepers and other service providers to help them manage and grow their business.

If you want more one to one help in marketing your services or closing sales for new clients we have dedicated support packages to do just that as well.

Your regional licencee manager is dedicated to help you develop all your business skills and that includes the confidence to build a solid sales and marketing strategy to grow your business. You don’t have to be bold and brassy to sell your own bookkeeping services – you can be yourself – but the more you understand about the subtlety of selling the more you understand how to incorporate it into your daily conversations.

See what sales and marketing services are available in the National Bookkeeping Licencee opportunity.

Directory Listing and Exposure

Directory Listing and Exposure

Licencees receive a legal pack (including template agreements), their own unique directory listing and a phone number that can be used to show how much demand there is for their services.

You’ll go through most of your learning in the first year so the ongoing costs are quite low.

A fantastic feature of a National Bookkeeping license is that it’s based on upskilling your in your first years of business and being rewarded for that and then providing a system where all members benefit by group level marketing.

Regional Licencee Manager

The success of our service is based on you doing a great bookkeeping job, keeping customers happy and getting new clients so you’ll have access to a regional manager who’s job is to ensure you receive the training you need, support at critical times and to ensure you provide great customer service to your clients.

The success of our service is based on you doing a great bookkeeping job, keeping customers happy and getting new clients so you’ll have access to a regional manager who’s job is to ensure you receive the training you need, support at critical times and to ensure you provide great customer service to your clients.

Your Regional Manager will guide you through the path of business ownership as well as be available in difficult times, with difficult customers or just to chat about your business.

Your manager has access to technical, accounting and small business specialisits so they’ll guide you along your journey if you need help.

30 Day Money Back Guarantee

We’ve put in a lot of work over many years to assemble an education program we believe in and a marketing system to help you attract and win new clients. We also understand that you are putting your faith in us to start and develop your own professional consulting business so we offer you a money back guarantee.

We’ve put in a lot of work over many years to assemble an education program we believe in and a marketing system to help you attract and win new clients. We also understand that you are putting your faith in us to start and develop your own professional consulting business so we offer you a money back guarantee.

If you decide that you are not satisfied please contact us and let us know and you’ll receive a refund

Please read the details of our Money Back Guarantee.

Bookkeeping Mission Statement

Bookkeeping Mission Statement

Small Business Startup and Admin Courses

Small Business Startup and Admin Courses Directory Listing and Exposure

Directory Listing and Exposure