Xero Beginners’ to Advanced Certificate Training Courses

Xero Beginners’ to Advanced Certificate Training Courses

Choose from our range of Xero online training courses suited for all skills levels including:

Short Courses in Xero Bookkeeping

Short courses in Xero for specific features and skills.

- Certificate in Xero (Beginners Course)

- Advanced Certificate Xero Accounting &

- Advanced Certificate in Payroll Administration Training Courses.

These Xero Courses are ideal for job seekers, employees and business owners.

Industry Endorsed & Industry Connect Xero Courses

Xero course packages for job seekers and bookkeepers or business managers who want to manage their own business accounting.

- Xero Accounting Pro Training Course Package

- Xero & MYOB Bookkeeping PLUS Course Package

- Xero & MYOB Certificate Courses with Industry Connect

Nationally Accredited Bookkeeping Courses

Nationally Accredited Bookkeeping Courses which include Xero & MYOB Training. Ideal for career progression or to become an independent contract bookkeeper and BAS Agent.

Start a Bookkeeping Business

Don’t sell out to a bookkeeping franchise that will forever own a percentage of your business, even when you decide to sell your business. Low cost bookkeeping business license where you keep the money you earn.

Why Learn How to Use Xero

Xero is a leading accounting software program, used by a growing number of small to medium businesses.

Our bookkeepers, BAS Agents and Accounting Tutors love it because it enables you to get your accounts done remotely by great bookkeepers, no matter where they are located.

Our Xero Certificate Training Courses are designed for

- Job Seekers who need to up skill to use online accounting software,

- Bookkeepers who want to learn Xero and expand the services they provide

- People who want to start their own contract bookkeeping business and work remotely from home

- Business owners who want support and help to manage their own books

Xero Certificate Training Courses for $25 per week

All Australian students are eligible for no interest Xero courses for Beginners to Advanced Online Training Courses in

- Xero,

- QuickBooks Online, and

- MYOB Accounting software (MYOB AccountRight and Essentials).

Choose the training course or package you want and pay a low weekly fee so you can manage your cash-flow while studying for your new career or business.

Learn more about our course financing options: Student and Business Startup Lending

Structured Short Online Xero Training Courses

Xero Bookkeeping Certificate Training Courses

Xero Accounting online training courses are available individually to give you specific technical skills, or as part of a package to provide a career pathway that includes immersive practical tasks and one to one tutor support.

These courses include:

- Certificate in Xero

- Advanced Xero Certificate Course

- Xero Professional training package

Xero Accounting Certificate Training Courses.

Job Placement or Earnings Guarantee

If you are looking for an opportunity to work, get experience and earn money after your studies we can help you with our Career Academy services.

One of the reasons that students choose 123 Group and National Bookkeeping is because we offer a low cost Bookkeeping Business training and marketing system. Rather than spend $35,000+ on a bookkeeping franchise where you are tied to the franchiser we offer a brand licence and marketing system.

Members get to operate their own business without paying franchise fees and use our services as long as we provide a valuable service. An Earnings Guarantee and Payment Plan is available to approved applications.

Learn how to start a Bookkeeping Business

MYOB and Xero Training Course Packages

Bookkeeping Packages in Xero, MYOB and QuickBooks Online include

- skills training in how to perform bookkeeping tasks, combined with

- the Career Academy support services aimed at helping students better define their job search, and

- Industry Connect to speak with an industry practitioner about the tasks they perform using the software.

These MYOB and Xero training packages come with the option to become a tutor or become an affiliate. Check out the Bookkeeping PRO Package if this interests you.

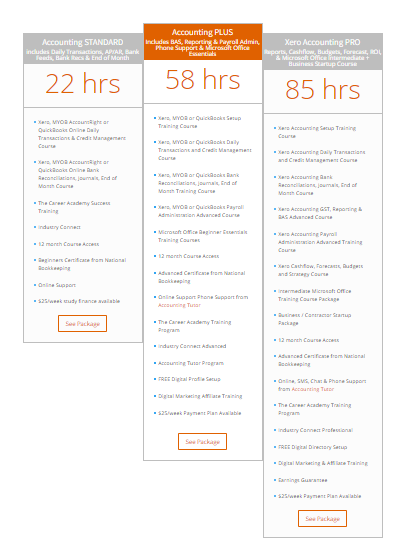

Compare Bookkeeping Training Course Packages

Role-Based Xero Training Course Packages

Junior Bookkeeping & Office Support Roles

If you are looking to train one of your staff at “junior” accounts level for Accounts Receivable and Payable; Credit Management and possibly End of Month Bank Reconciliations, we would suggest choosing

Xero Accounting STANDARD Package>

Accounting Administration, Accounting Manager or Payroll Administration Roles

If you are looking for “advanced” Xero Training including GST, Payroll, Superannuation and Reporting, choose

Become a Xero Guru and Accounting Tutor

If you’re looking for Cashflow Management, Return on Investment and more advanced features to give yourself a great understanding of your financial position every week, then choose the

Compare the features and inclusions with each course and the Xero Accounting Training Course Package Pricing.

Accounting Training Course Packages

Below, you can read about what our Xero online training courses cover in even more detail.

Beginners to Advanced

Xero Accounting Training & Support

included with Learn Express

The cheapest way to get access to a whole lot of content on everything Xero-related is with our latest feature, Learn Express.

Learn Express is membership to a training resource whereby you can access all skills level of Xero via an online video tutorial format.

Plus if you need help with something that’s not included in the library, we’ll create it for you!

Beginners’ to Advanced

Xero Training Video tutorial library

Learn more about Learn Express

Xero Accounting Course Tutors

Want more personalised support with your Xero Training Course? Choose a course option which includes accounting tutor support and get the attention you deserve.

Xero Accounting Training Course Outline Summaries

Xero Accounting Setup Course

Our Xero Setup Course is an online training course, taught through videos and a workbook, using real business scenarios, that will equip you with the knowledge to become a bookkeeper; helping you understand the most important aspects of bookkeeping, as well as the financial and accounting aspects of what small business owners need to manage, including:

- Charts of Accounts

- Tax Codes

- Cash vs Accrual Accounting Methods

- Debits-Credits-Income-Expenses

- An introduction to Credit Control

Following this, you’ll learn how to use the software in the actual management of a business, including:

- Introduction to navigating the Xero Accounting Software

- How to access and use the Free Software Trial

- Setting up the Organisational Settings

- Financial Settings

- Invoice Settings and Users

- Chart of Accounts

- Account Balances

- Default Invoice Settings and Email Settings

- The Dashboard Watch List and How to Add a New Contact

- Adding Multiple Bank/Credit Card Accounts

- Adding PayPal Accounts to Receive Credit Card Payments

- How to Manage Bank Accounts from the Dashboard

♦ Find out more about combining your online training course and one-to-one training with an industry professional

Xero Accounting Beginners’ Certificate Training Course

In our Xero Accounting Beginners Essentials Certificate Course you’ll discover the different dashboards for various parts of the Xero software.

You will learn your way around the main screen dashboard, as well as your Sales and Purchases Dashboards.

Learn:

- how to send or issue invoices to one customer or many customers at the one time, to save a repeating invoice and much much more

- how to work with credit notes: these could not be simpler when using Xero; you won’t get confused with them and they take seconds to generate, just like a sales invoice

- how to manage payables which happens at the purchase dashboard. Schedule payments, create bulk payments and ABA files, send suppliers a remittance, as well as process employee expense claims

Our Xero Accounting Beginner Essentials Course also includes training on:

- Entering Sales Invoices and Receiving Customer Payments

- Entering Supplier Invoices and Entering Supplier Payments

- Transferring Money Between Accounts

- Adding New Contacts

- Edit existing Contacts and Coping with Duplicate Contacts

- Navigating the Sales Dashboard

- Entering Credit Note and Allocating them to Invoices

- Emailing or Printing Invoices

- Entering a New Purchase Order

- Sending a Purchase Order

- Deleting Invoices

- Voiding Invoices, Voiding Invoices when payments are applied

- Internal Bank Transfers

- Handling Overpayments

- Processing Contra Deals

- Creating a Quote in Xero

- introduction to Reports

- Balance Sheet (Assets and Liabilities)

- Profit and Loss (Income and Expenses)

- Reporting for Fixed Assets

Xero Accounting Beginners’ Certificate

Training Course includes

- Journal Entries,

- Bank Reconciliation &

- End of Month Reporting

Once you’ve mastered the data entry and credit management aspects of using Xero you’ll explore a sample bank statement and enter data for that period as well as the direct debit transactions that aren’t entered as part of the Daily Transactions.

You’ll understand how to code ad hoc payments for director wages, capital purchase of a vehicle and depreciation of that vehicle.

You’ll use the figures to explore alternatives ways of buying a vehicle for the business like leasing or a secondhand car purchase under $20,000.

You’ll perform a bank reconciliation that doesn’t balance, and then go through the entries to sort out the issues and miss-typing that tends to happen in almost every business.

Learn:

- Entering and coding direct debits

- Interest payments and charges

- Coding capital purchases

- Understanding depreciation

- International credit card payments and charges

- Basic Payroll entries for micro businesses

- Loans to and from the company

- Experience a bank rec which doesn’t balance

- Rectify entries to complete the bank reconciliation process

Xero Advanced Certificate Training Course

- GST,

- Monthly Reporting &

- End of Quarter BAS training

In the Xero GST, Reporting and BAS Course, learn about the transactions that can make GST and BAS reporting tricky; including purchases which are GST-free, those which have partial GST, or international payments. Also learn about transactions with varying GST percentages and how you can use a spreadsheet to calculate your PAYG & Super obligations and then just code them into your Xero software.

The following topics are included in this course:

- GST treatment for capital purchases (a vehicle)

- How different costs of running a vehicle are treated

- When FBT applies to expenses like entertainment

- Introduction to Payroll & how wages are treated in the BAS

- Financial settings with regard to the GST registration (Cash vs Accrual and quarterly vs monthly)

- Run a BAS report, which is combined with our specially-designed “Ad Hoc Payroll” Excel spreadsheet case study calculations in order to work out the final liability

- See the financial results of the business owners ‘change of strategy’ and focus

- See what these results look like at the end of the quarter, as well as month-by-month comparisons of Profit and Loss and Balance Sheet reports

- How the business owner can use the information in the reports to change the direction of the business

- Configure software to obtain even better reports at the end of the next quarterly reporting period

Xero Advanced Certificate Training Course – Cashflow, Budgets and Forecasting

- Cashflow,

- Budgets,

- Forecasts & Strategy

Our Xero Accounting Cashflow, Budgets, Forecasts and Strategy Course features an ongoing case study, involving real-life scenarios to make learning fun and relevant. In this case study, you’ll join the journey of a business owner, perhaps just like you, experiencing a major change in the services they are providing.

In terms of using the software, you will learn to:

- Import the bank transactions

- Manage the many and varied transactions

- Purchase a commercial building

- Account for a commercial building loan

- Explore the typical ‘overspending’ that some entrepreneurs experience and how to deal with this

- Understand how asset purchases affect cashflow

- Learn about the financing, operational and investment aspects of a cashflow statement

- Learn alternative strategies regarding asset purchases credit-risk management

- Create Credit Management reports, Aged Receivables & how to get money into the bank account quicker

- Use accounting software to improve marketing and operational management by budgeting and understanding Return On Investment (ROI)

♦ Find out more about combining your online training course and one-to-one training with an industry professional

Xero Accounting Payroll Administration Training Course

The videos below are included in our Xero Payroll Course and will aid and assist you to correctly set up your payroll users and settings so that you can start adding employees and processing pay runs. We show you how to set up your linked accounts, take you for a look at the individual pay and line items, and how to add a new (or various) payroll calendars.

This Xero Payroll Course includes:

- Setting our user permissions

- Linked Account Set Up

- Payslips Set Up

- Pay Items Set Up

- Calendar, Payroll Settings and Superannuation Set Up

- Employee Details

- Tax Declarations

- Leave

- Bank Accounts, Pay Templates

Processing Payroll using Xero

- Xero Payroll – Timsheets – Entering Timesheet Information

- Xero Payroll – Pay Runs – Posting a simple pay run

- Xero Payroll – Pay Runs – Pay Run Options

- Xero Payroll – Create a New Company File

- Xero Payroll – Set up your Company Details

- Xero Payroll – Add your Payroll Bank Account

- Xero Payroll – Set up your Payroll Liability and Expense accounts

- Xero Payroll – Create Pay Calendars

- Xero Payroll – Create Employee Cards

Xero Payroll Course – Payroll Dashboard

- Xero Payroll – Familiarise Yourself with the Pay Items

- Xero Payroll – Allowances, Termination Payment, Ordinary Hours, Overtime hours and more

- Xero Payroll – Deductions, Reimbursements and Leave Categories

- Xero Payroll – FBT, Leave Payments, Post-Tax and Pre-Tax Deducations

- Xero Payroll – Pay Templates

- Xero Payroll – Information about the Superannuation Guarantee

- Xero Payroll – Superannuation Types – Fixed, Percentage of Earnings or Statutory Rate

- Xero Payroll – Setting Pay Periods

- Xero Payroll – Perform a Pay Run

- Xero Payroll – Print & Email Pay Slips to Employees

- Xero Payroll – Pay Runs & Payroll Activity Reports

- Xero Payroll – Suggestions/Recommendations

- Xero Payroll – Create a Card for a New Company Employee

- Xero Payroll – Create a New Account

- Xero Payroll – Create a New Pay Item

- Xero Payroll – Update Employee Payroll Details & Perform Pay Runs

- Xero Payroll – Edit a Pay Run

Xero Payroll Reporting Course

- Xero Payroll – Print a Payroll Activity Summary Report

- Xero Payroll – Print a Payroll Employee Summary

- Xero Payroll – Reconcile Superannuation & Wages

- Xero Payroll – Reconcile the PAYG Taxes

- Xero Payroll – Reconcile Liabilities to Balance Sheet

EOY Xero Payroll Procedures

- Xero Payroll – Create EMPDUPE

- Xero Payroll – Print out the Payment Summaries

Xero Payroll Course – Employer Obligation Information

- Differences between full-time, part-time and casual employees

- Salary Sacrificing

- Employer Obligations relating to Super

- Employee Eligibility Criteria for Superannuation

- Pay Slip Requirements

- TFN Declaration Forms

After completing these scenarios and case studies you’ll work on some more complicated examples.

Xero Accounting Advanced Payroll Administration Training Course

- Set up Timesheet Preferences

- Edit an Existing Super Payroll Category

- Create a New Super Payroll Category

- Add a New Payroll Category

- Edit Employment Classifications to Suit the Business

- Create a Casual Employee in Xero

- Create Permanent Employees in Xero

- Enter Timesheets in Xero

- Process a Pay Run

- Import Timesheets

- Process Payroll with Personal Leave included

- Create a New Deduction Payroll Category

- View Employee Leave Accrued

- Process Pay including Annual Leave

- Run a Payroll Entitlements Report

- Run a Payroll Journal Report

- Produce a Balance Sheet

- Record your Bank Details

- Record Employee Bank Details

- Process a Pay Run

- Create an Electronic Payment File

- Process Final Pay

- Update Employee Card File

Compare Xero Short Training Courses

Our Xero Accounting Training Course

“Package Offers”

Enrol in our Xero online training courses as a package option. Find out more about the packages we have available

One on One Training

One on one training gives you full support to solve your knowledge gaps or resolve an issue that you’d like to solve. It’s perfect for very specific situations or when you don’t want distractions from other students or irrelevant content.

The benefits of combining one-to-one training with the structure of an online training course

I’ve been a Bookkeeper for more than 20 years and find more and more business owners are asking for training because today’s bookkeeping tasks aren’t quite as easy as the software companies make out. Learning how to use bookkeeping software one-to-one combined with an online course is a great way to learn because, as a trainer, I cover all the topics my clients need in a logical order which follows the flow of the course and which will also help them in their daily operations, but clients can also learn what they need to specific to their own situation.”

— Tracey O’Neill, Registered BAS Agent and Bookkeeper, QuickBooks Pro Advisor

Why Xero?

Xero is great for business bookkeeping because it saves you time, money, travel and hassle compared to desktop accounting software, However, not using Xero correctly can start with small niggling inconsistencies and soon build up into a large, complicated and overwhelming accounting mess! This, in turn, can result in time-consuming “undoing” of work and then spending precious time performing catch up or rescue work.

Many of our clients who are just starting out in business, or having problems with Xero, have benefited from our one-to-one and private face-to-face training and tuition options

These are some common issues:

- Xero Payroll: Meeting the correct awards, hourly rates of pay, leave accrual and superannuation calculations & payment (payroll)

- Xero bankfeed issues and errors — missing entries, duplicate entries, missing transactions. All these need to be sorted out before your bank account and software can be reconciled (end of month)

- Problems with credit management, managing quotes, invoicing and bills (daily transactions)

- Incorrect setup at the very beginning — small issues soon become a lot more complicated (setup)

Xero is intuitive and relatively easy to use, but if you are experiencing problems with Xero you’re not alone!

As a business startup or established business owner, there are better things for you to be spending your time on than setting up your accounts through trial and error — particularly when you’re relying on your accounting and financial reports to determine how well you’re going and where you need to focus your own time and energy.

Xero Accounting

Xero Accounting

Training Course

Packages & Pricing

You can do our Xero online training courses individually, or you can choose one of our Xero Accounting Training Course Package Options.

I’ve been a Bookkeeper for more than 20 years and find more and more business owners are asking for training because today’s bookkeeping tasks aren’t quite as easy as the software companies make out. Learning how to use bookkeeping software

I’ve been a Bookkeeper for more than 20 years and find more and more business owners are asking for training because today’s bookkeeping tasks aren’t quite as easy as the software companies make out. Learning how to use bookkeeping software