Rostering and Scheduling

Rostering is a time consuming part for business administrators to ensure that the right human resources are working to fulfil the needs of customers.

Rostering occurs on a regular basis and is prone to constant change for many reasons including sickness, personal circumstances, holidays and natural disasters or accidents.

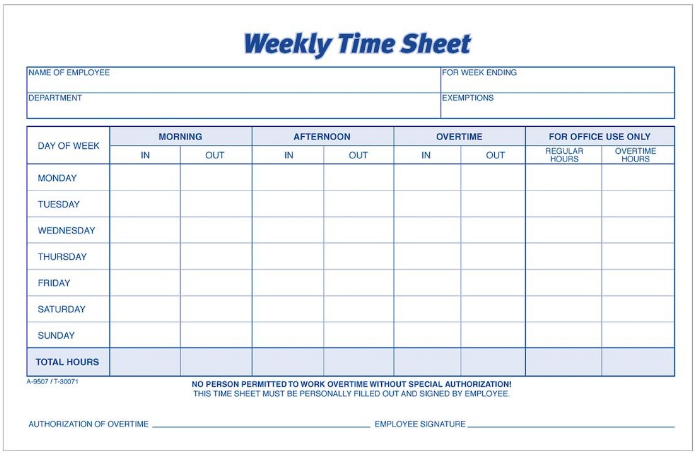

Time sheets

Timesheets are the source documents that every business needs to maintain at the beginning of the payroll process (after someone has been hired of course).

These documents are evidence of your staff’s time spent at your business and this information is critical in the case of hospitality and retail type businesses because of the penalties and awards that come with working in these industries.

Some companies maintain electronic sign in systems that require staff to swipe, scan or punch in their details and it encourages accurate and up-to-date timesheet information recording.

Payroll Processing

Payroll processing is critical not only to keep staff happy but to maintain legal compliance. Processing payroll uses information from the timesheets or roster and takes into consideration the employees award, employment status (fulltime, casual etc) and in some industries the level of risk of the work they do. In the case of full time and part time employees payroll processing also means managing liabilities like PAYG, sick pay, holiday pay and of course superannuation.

If you are manually recording staff work hours you must consider how these files are recorded, filed and then accessed when payroll processing occurs. Although it may seem easier to track workers hours manually it’s often better to spend a little extra and introduce a system in your business to collect time sheet information electronically for these reasons:

- It makes staff accountable for accurate record keeping

- It enables flexible storage that can be accessed remotely if needed

- Electronic data can be backed up offsite

- Saves on manual data entry by your bookkeeper

- Enables you to hire remote contractor bookkeepers

The complexities in payroll and the fact that a business holds taxes for the employee that need to be paid to the ATO, payroll tasks and subsequent liability reporting should be performed by a BAS agent if your business is contracting the payroll task to an independent contract bookkeeper.

Payroll Reporting

Once an employee is paid the ATO requires employers to provide their employees with a payslip that shows the net and gross pay as well as information about other payments that have been withheld, tax withheld, super etc. It is also a good idea to run internal company reports so you are aware of the liabilities the business has to pay to the ATO – these funds should be set aside.

If you operate a service based business where you charge your staff out it also becomes important to understand time billing and job management to help you understand the total cost of providing services to your clients.

Annual Payment Summary

The final payroll report which you run at the end of every financial year is called the Payment Summary or often referred to as a “group certificate” and for many businesses it is a simple report which you can run from your accounting software but there are many different types of group certificate depending on where your workers come from, if they are leaving your company etc. Visit the ATO’s Payment Summary web page for the full details.

How can we help?

Whether you just need payroll services or have them combined as part of your weekly bookkeeping service we can help. Tell us about your business and we’ll provide you with a quote for your payroll solution.

Payroll Training Courses in Xero, MYOB and QuickBooks

All the major Accounting programs will help you perform these tasks, be compliant with the ATO and Superannuation requirements and create important reports.

If you want to explore a career as a payroll professional ask us about our Payroll training courses which include Industry Connect.

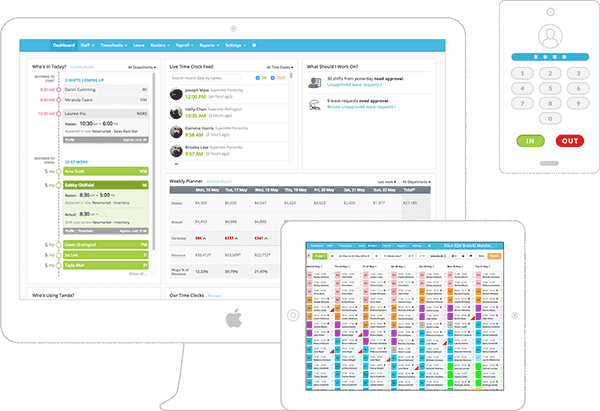

Xero, MYOB and QuickBooks Workforce Management Integrations

With the need for the major accounting software companies to constantly grow they are acquiring and integrating with “specialist” software programs that manage the day to day Rostering, Attendance Management, holidays and staff communications.

The most popular of these applications include:

- Deputy,

- KeyPay

- TSheets, and

- Planday

Tsheets is now owned by Intuit (who publish QuickBooks Online) and Planday was recently acquired by Xero.

Find a good local bookkeeper Cloud Accounting Packages Request a Quote