What is a BAS Audit?

A BAS Audit involves somebody going through your BAS lodgement information and confirming that the information is accurate. The information that is lodged with the ATO for each BAS Service is an indication of exactly how much GST and other taxes you own the Australian Federal Government so this process and the professionals who can provide the BAS lodgement has become regulated in a system administered by the Tax Practitioners Board. A BAS audit can be performed by a BAS Agent prior to lodgement or it can be performed by the ATO because of inconsistencies in the BAS information submitted.

A BAS Audit involves somebody going through your BAS lodgement information and confirming that the information is accurate. The information that is lodged with the ATO for each BAS Service is an indication of exactly how much GST and other taxes you own the Australian Federal Government so this process and the professionals who can provide the BAS lodgement has become regulated in a system administered by the Tax Practitioners Board. A BAS audit can be performed by a BAS Agent prior to lodgement or it can be performed by the ATO because of inconsistencies in the BAS information submitted.

How can we help bookkeepers with a BAS Audit?

Our Registered BAS agents can take the data that is entered by your accounting staff or contract bookkeeper and put it through some reporting reconciliations to ensure that the information is authentic. They’ll also review tax codes that are known areas of difficulty or confusion and ensure that the transactions are coded correctly. Common areas where the GST component of your business may get complicated include these events and scenarios so be aware if one of them has occurred in your business this financial year:

- Purchasing a motor vehicle

- Motor vehicle expenses

- Real property purchase

- Any purchase coded as a GST-Free transaction

- Low value purchases (under $82.50) that are coded as GST free

- Purchase of second hand trading stock

- Hire Purchase contracts

- Local fees and handling charges for imported goods

Your business and its benchmark

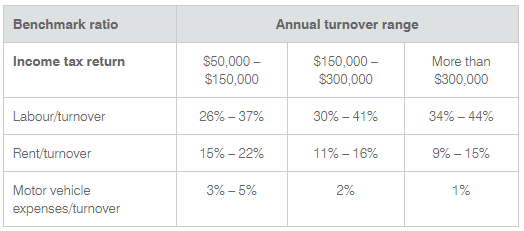

Benchmarking is one way that the ATO compare the information gathered from your financial returns to the information they gather from all other similar businesses. Take the example of a hairdressing salon which may take a lot of cash payments and have a high staff cost. The ATO has historical information from thousands of other hairdressers over many years and can determine a great deal of information about your financial returns.

Benchmarking is one way that the ATO compare the information gathered from your financial returns to the information they gather from all other similar businesses. Take the example of a hairdressing salon which may take a lot of cash payments and have a high staff cost. The ATO has historical information from thousands of other hairdressers over many years and can determine a great deal of information about your financial returns.

Although we’ve only included information about hairdressing salons you may find it interesting to visit the ATO Benchmark web page and discover the benchmark ratios for your business type.

Self assessment for GST and BAS purposes

When you are registered for GST you have a duty of care to make sure you are aware of the taxes you are collecting on behalf of the Australian government and the ATO encourages businesses to conduct self assessments, particularly when there are significant changes in your business, including changes in:

- company software

- key personnel

- business structure

- GST regulation

- significant shifts in the size and scope of the your business

- an unusual or complex transaction (see the checklist above)

For more information about self assessment, visit the ATO Self Assessment web page.

Request a Quote

If you are interested in working with a professional team of bookkeepers who adhere to strict codes of conduct then request a quote for BAS Services, Payroll Services or all of your bookkeeping work.

Request a Quote