Everything’s Included for One Low Price!

Learn every aspects of how to use your MYOB Accounting software with the MYOB PRO online training courses & certification.

MYOB Training Course Outline

Our MYOB training currently includes 5 MYOB courses:

- MYOB Accounting File Setup & Customisation

- MYOB Training in Data Entry, Sales, Purchases, Accounts Receivable, Accounts Payable, Credit Management & End of Month Bank Reconciliation & Credit Reporting

- MYOB Education Advanced Certificate including Financial Reporting, GST and BAS, Payroll Administration & Job Tracking & Reporting

Our online MYOB training courses comes with the assurance of a 14-day money back guarantee and you get 12 months access to the training courses so when you need support you can go back and refer to the training videos, workbooks, case studies and knowledge reviews.

Below you can read our MYOB Training Course Outline of everything that is included in our online MYOB Training courses delivered Nationally across Australia.

MYOB Training Course Outline:

This MYOB Training course outline list of the topics currently covered in the course and you’ll be able to repeat and review the course as often as you want and have access to new material as our MYOB courses are updated regularly – All for no extra charge.

MYOB AccountRight Setup and Customisation Training Course

Create a New MYOB Company

Creating a new company, new company accounting info, accounts list and filename, data entry & record selection options, contact log, to do list, help, description of accounts list, creating and deleting accounts, entering opening balances

Set Up Your New MYOB Accounting Company

Sales layouts, selling and payment defaults, linked accounts for sales, creating customer cards, historical sales, purchases setup, security preferences, sales preferences

Chart of Accounts and Opening Balances

Tax codes, accounts list, edit and delete accounts, intro to linked accounts, edit and delete linked accounts, entering opening balances, Customer and Supplier Cards and Inventory

Creating supplier and customer cards, extra card file details, supplier bank account details, creating items, extra item information, inventory opening balances, inventory adjusting balances

Backup and Restore MYOB Datafile

Closing and backup, backup on multiple disks, opening your new file, restoring a backup file

Customise Forms

Introduction to customising forms, invoice form layouts, tax inc vs tax ex invoice layouts, text fields vs data fields, deleting fields and lines, moving and resizing fields, customising toolbar, form properties, text formatting for fields, copy and paste logo into form, inserting a logo image file, final form customisations

See MYOB AccountRight Setup & Customisation Training Course

MYOB AccountRight Sales, Purchases A/R, A/P, Credit Management, Bank Reconciliation Training Courses

Sales Module

MYOB Main Command Centre screen, MYOB Sales Command Centre screen, MYOB sales layouts, entering items, changing item information, changing payment terms, entering a service invoice, time-billing and printing, creating a sales quote, creating a sales order, converting quote to order, converting order to invoice, convert order to invoice in sales register, inserting & deleting lines & headings

Finding Transaction Details

Sales register, transaction Journal, to do list navigation, to do list – AR and AP, intro to statements, intro to find transactions, find transactions in detail, keyboard shortcuts, receive payments and pay bills, custom lists in sales & purchasesEmail and Print Invoices and Statements

Printing receipts, print or email an invoice, printing unprinted invoices, emailing or printing statements, email or print activity statements, invoice vs activity statements

Credits, Bad Debts and Reversals

Recording a cash sale, entering credits, settling credits and returns, bad debts, deleting payments & sales, reversing transactions, creating a card on the fly, creating an inventory item

Receipts and Part Payments

Apply a payment while invoicing, receive payments account, receive payments for an invoice, receive part payments, receive over paymentsPurchases Module

Receive money and pay bills, creating a purchase, creating a purchase order, converting purchase order to bill, create an item credit, purchases register, settling credits, reverse or edit a purchase, how much do you owe, payment for purchases, analyse payables

Banking Module

Intro to bank register, spend money, receive money

MYOB Bank Reconciliation — Data File & Loan Account

Data file – download and opening the training company data, creating a loan account, transfer loan funds, transaction details and accounts payable, setup accounts payable linked account, editing or deleting a transaction entry

MYOB Bank Reconciliation — Entering Transactions

Creating customer cards, creating inventory items, entering a sale and payment, spend money, receive money from a client, reconcile your cheque account to your bank statement

MYOB AccountRight Advanced Training Courses

MYOB AccountRight Reporting and BAS Training Course

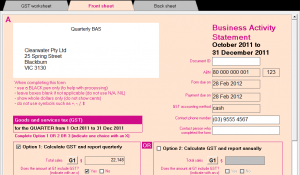

Learn about how GST is calculated on each sale, purchase, deposit and withdrawal, GST reports, How to complete your BAS using MYOB’s BASlink, Setup your BAS Info and backup the completed BAS report for that period.

Learn about the GST and BAS reports, plus Capital Reports (Assets and Liabilities), Profit and Loss and Cashflow reports

MYOB AccountRight GST Reporting & BAS Training Course

MYOB AccountRight Payroll Administration Training Courses

MYOB Payroll — Navigating and Finding

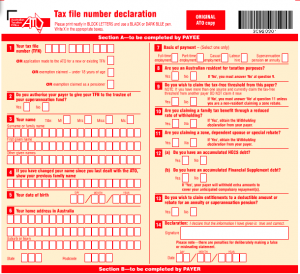

MYOB payroll and card file command centres, payroll categories, employee payroll information, employee payment transactions, employee payroll advice report.

MYOB Payroll – Processing Pays

Once you are familiar with navigating around the payroll command centre module of MYOB you’ll learn how to load the current tax tables, create new employee cards and assign wages categories, taxes and deductions for them, setup the superannuation guarantee for qualifying employees and extra super features like salary sacrifice.

Once all the correct data has been entered you’ll process the weekly pay, look at where transactions are entered in the Accounts list (chart of accounts), make modification or deletions if required, process the payment of payroll liabilities and superannuation payments and deductions like the social club and provide employees with their legislated advice slips and payment summaries.

MYOB Payroll – Reporting and Reconciliation

Run several reports including Payroll Summary, employee register, balance sheet and profit and loss to reconcile the entries and payments you’ve made, printing of End of Year summaries for employees and backing up your data and closing the payroll year.

See MYOB AccountRight GST, BAS & Payroll Administration Training Course