Level 2 and Experienced Junior Bookkeepers

Roles & Responsibilities

Level 2, accounts clerks & bookkeepers have usually been performing common office tasks relating to financial transactions of the business for at least 2 years. As a result they know the business they work for quite well and have a relationship with key suppliers and/or customers.

Level 2, accounts clerks & bookkeepers have usually been performing common office tasks relating to financial transactions of the business for at least 2 years. As a result they know the business they work for quite well and have a relationship with key suppliers and/or customers.

Tasks include:

- filing papers (receipts, quotes, work orders, purchase orders etc)

- handling mail & email (Microsoft Outlook or Google G Suite)

- data entry for money coming into and going out of the business (income & expense record keeping and everyday transactions)

- data entry for orders and sales (debtors & creditors)

- receiving and making calls to customers (accounts receivable)

- receiving and making calls to suppliers (accounts payable)

- following up on overdue invoices (credit management)

- being available to the other business areas who need the financial information.

Other tasks performed by a level 2 bookkeeper include:

- Reconciles invoices and dispatches payments.

- Calculates, analyses and investigates the costs of proposed expenditure, wages and standard costs.

- Prepares bank reconciliations.

- Allocates expenditure to specified budget accounts.

- Summarises expenditure and receipts.

The job title for Level 2 bookkeepers may also be “Office Support, Office Administration and Credit Manager”.

Who are Level 2/Junior Bookkeepers?

Level 2 bookkeepers, Office support and Accounts Clerks sometimes have accounting degrees and are starting out in their accounting career but most commonly have a vocational Cert II to Cert IV in accounting and bookkeeping. Many of these employees don’t have a tertiary qualification but may have completed a short course or what is known as a pre-accredited course.

Their level of experience is good but often it’s at a low level and usually in just one, maybe two industries because of the short amount of time they’ve worked in the sector. As a result, they may need training, instruction and support from someone more senior in the company to progress in their career.

Benefits of Hiring Level 2 Bookkeepers and Accounts Clerks

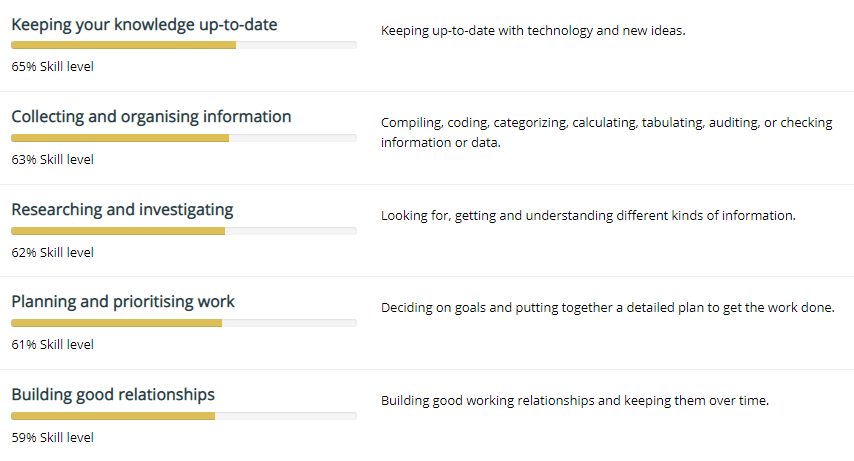

Typical tasks performed by Level 2 Bookkeepers and Accounts Clerks

A major benefit of hiring a level 2 bookkeeper is that they don’t cost a lot, they are available to you most of the time you need them — and usually in your office or very close by and they have some experience and confidence in performing the role so don’t need to be micro managed.

They can be employed to enter all financial information into an electronic accounting system which can then be accessed by finance managers, business owners and the company accountant. When all of the information is entered into an electronic (and often cloud-based) accounting program it can be accessed easily for chasing up payments and reporting performance.

Another common type of person who performs this junior level of work is a part-time employee or a contract bookkeeper who wants to work flexible hours.

Reasons to become a Level 2 Junior Bookkeeper and Accounts Clerk

People desiring flexible hours may be parents with children, or perhaps someone who has previously worked in a larger company in the city, but doesn’t want the stress of commuting or long hours anymore.

These bookkeepers are in the “family” stage of their life normally so they just want to get into the work, do a great job and then get home to their families. Their capacity to multi-task and manage difficult situations sometimes helps them in their work.

Other people who apply for this accounts job are people changing careers and school leavers.

Who Do Level 2 Junior Bookkeepers & Accounts Clerks Report To?

These junior-level bookkeepers usually perform tasks which are transactional and regular reporting at an operational level. They are generally instructed by the business:

- accountant

- finance manager

- registered BAS agent

Level 2 junior bookkeepers often require supervision on tasks that can only be performed by a registered BAS agent or accountant, and include areas where account codes must be applied to transactions.

Learn more about the National Bookkeeping Business Opportunity for Junior Bookkeepers