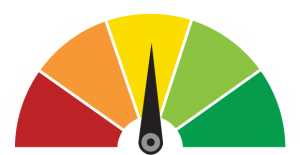

Credit Management Stages

New Client Credit Assessment

New Client Credit Assessment

The first stage of a good credit management process is to ensure that you have clear terms that show how you manage the credit you extend to your clients. It’s important that every client receives and agrees with these terms and that you followup on everything in your agreement.

Credit assessment may also include doing a credit check and deciding on how you want to handle deposits or prepayment and then progress payments and if you are in the building and construction industry you’ll find that some of these aspects are actually regulated by state laws.

A good bookkeeper will ensure that these new client credit assessment steps are taken and that your terms and conditions are administered throughout the credit management stage.

Weekly Credit management

A good example of the credit management process is to see how long it takes for the CASH to CASH cycle. Put simplistically the CASH to CASH cycle goes a little like this:

- You start with cash in your bank account,

- Buy products as inventory,

- Sell them on credit terms, and then

- Receive the cash back with your added margin.

This is the cash-to-cash cycle that you need to manage to ensure that the time between the two cash stages is as short as possible.

This process includes buying the right items to sell and selling them at the right price and this is more of a marketing role, but a good bookkeeper will ensure that your terms of trade and credit policies are adhered to to ensure you get to the final cash stage as fast as possible.

Good credit management includes regular reporting to understand how much is owed and when it is due (called aged receivables) and most importantly following up with every client when they are outside of the terms they have agreed to. These followups can be phone calls, emails, text messages and even automated messages delivered by your accounting software.

If a client begins to stretch your credit terms they could be using your business to fund their own business and a good bookkeeper with credit management knowledge will also help with the enforcement stage.

Credit Enforcement

If clients aren’t adhering to your credit terms it could be for a number of reasons including that you didn’t set out in the beginning how seriously you take prompt payment.

If you do get to the stage where you are due a progress payment or a final bill needs to be paid there are several steps you can take and in the building and construction industry these steps are regulated by State Governments.

The longer a debt is outstanding the less that debt is worth and the harder it may become to get that payment so following strict credit management procedures is important and a good bookkeeper can help you manage it without you getting emotionally involved.

Regular Telephone, Emails and text messages

Apart from setting up strict credit terms one of the most effective ways of improving your credit management is to be in regular contact with your clients and if their circumstances are tight it could involve making small regular commitments and following up on them.

Sell or Outsource your Debt

Your accounts receivable debts can be sold, they can be factored out or handed to a debt collection agency. In the building industry you can seek adjudication that is enforceable by the sheriff. Find a good local bookkeeper to help you with good credit management.

Find a good local bookkeeper Cloud Accounting Packages