What Does a Bookkeeper Do?

What Does a Bookkeeper Do?

Some accounts staff perform many of these bookkeeping tasks at the same time while other organisations have specialist staff or contractors for different areas because of their large size and volumes – like accounts payable.

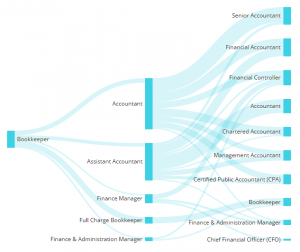

We’ve summarised the various tasks performed by bookkeepers so you can use them as a guide in conversations with bookkeepers. If you are a bookkeeper at any level you may be interested in the career, promotion or progression you can take based on your education and training as well as your experience. Read more about Potential Roles for Bookkeepers

Accounting System Setup

Setting up your accounting software, including the data file and account list, Correct links, preferences and tax codes, Customer, Supplier, Employee Cards and inventory items, Opening balances for accounts, debtors etc This task can be relatively quick and easy for a startup business but a long and time consuming task if you are moving large volumes of historical data.

Training someone how to perform most of these tasks can be provided by someone with Level 2 or above experience but any questions which relate to establishing accounts codes or anything to do with Payroll need to go through a BAS Agent or an Accountant.

Data Entry & Coding

Data entry for Day-to-Day Transactions is one of the most time-consuming tasks for small business, yet everything else is dependent upon it.

An important aspect of data entry is ensuring that all of the transactions are allocated to the correct category (or account in the chart of accounts) — you don’t want to mix up revenue with an inter-company transfer, for example. We’ve discovered that most business have the same, or very similar, transactions each month so once a pattern is established this type of work is quite repetitive but most entry level bookkeepers can do it.

These types of activity are ideal for a Level 1 or Level 2 Bookkeeper. Other activities include:

- Bills and invoices

- Recurring transactions

- Receipts and payments

- Make electronic payments

- Reconcile creditors

- Follow procedural checks

Bookkeeping Accounting Software Training

Many businesses have their employees do an MYOB, Xero or Quickbooks course not only to learn how to use the software but to help them systemise the bookkeeping and accounts processes and procedures.

These business will often outsource their bookkeeping to contractors because of the flexibility and potential cost savings but just want to understand each step of what needs to be done so that they hire well.

Online accounting courses are now often supported using email, website chat, SMS and phone support and One on One screen sharing support is also available.

See Online Training Courses & One on One Training Options

Accounts Receivable

Payment Terms are offered to customers for many reasons, sometimes as a sales incentive and other times because it is the only practical way to work with customers (for example the building and trades industries). Chasing money owed can be a daunting task but its very important in many businesses because it directly effects their cashflow and profitability.

Finance Managers, owners or accountants normally setup processes which can be performed by Level 1 and Level 2 bookkeepers. These system usually involves regular calls to creditors and followups to keep your accounts front of mind for their accounts payable bookkeepers.

See our Daily Transactions Xero Course for training on Accounts Receivable

End-of-Period Reconciliation and Reporting

Bank Reconciliation ensures that the data in your accounting software matches the transactions in your bank statements.

This work involves discovering errors in the data entry like dates or amounts as well as incorrect coding. This stage is important for accurate information when lodging Business Activity Statements (BAS).

Other activities include:

- Reconcile reports with BAS returns

- Check accuracy of all reports

- Follow up unreconciled transactions

- Organise and perform system back ups

- Reconcile bank and credit card accounts

- Run company data auditor and fix problems

- Set up users with passwords and audit trails

- Roll over data file for financial and payroll years

Learn about Catch Up or Rescue Bookkeeping

Payroll Administration and Payroll Processing

The managing of staff payments and salary reporting can be very time consuming and includes the following activities:

- Set up payroll categories and accounts

- Set up employee cards

- Enter/import time sheets

- Apply payroll legislative requirements

- Process pay, adjustments, leave etc

- Keep track of outstanding entitlements/leave

- Reconcile payment summaries

- End of year payroll rollover and tax table updates.

See Payroll Administration Tasks in Detail

BAS Preparation and Lodgement

The bulk of bookkeeping work is done in the bank reconciliation process and if everything is setup and entered correctly then preparing the BAS can take as little as a few minutes using most modern accounting software programs. These are aspects to consider regarding BAS preparation and lodgement:

- Correct codes used

- Only business expenses entered

- Payroll categories and payment allocated correctly

- Correct treatment of entries

- Reviewing all entries

- Lodging with the ATO

- Taking responsibility for errors

- Professional Indemnity Insurance to cover potential damages

Read more about BAS preparation and lodgement

Chief Financial Officer (Virtual CFO)

Most business owners and managers are familiar with the foundation financial reports of the balance sheet and profit and loss statements. However, many businesses need to focus more on their financial management and here’s why:

- as the size of a business grows, reporting is less about gut instinct and more about cold hard facts

- if a business is dependent on business loans and financing, then prompt and detailed reporting, forecasts and explanations are required regularly

- if a business is like a Not-For-Profit organisation it has many key stakeholders and audit requirements so all information needs to be accounted for

- if you’re in a retail business you’ll need tight credit controls, credit management AND inventory reporting

The tasks performed by financial controllers may often not require a full time employee (particularly if the business is growing) and can instead be overseen by a virtual or contract Financial Controller on a periodic basis.

Accounts Department

The growing trend of cloud based services in accounting software, telephone and other services like support systems, message etc have enabled businesses to choose their team based on the talent rather than the talent that is located within 20-30 kms of the business and this includes international businesses that operate in Australia and therefore need to manage their Australian accounting obligations.

Even if you are a growing medium size business you can now outsource your daily accounting functions, credit management and reporting to the team of your choice using cloud based technology.